Gujarat International Finance Tec-City (GIFT City) represents a pioneering initiative to create a globally recognized business district in India, designed to cater to international financial services and technology firms. Strategically located between Ahmedabad and Gandhinagar, GIFT City is India’s first operational smart city and home to its first International Financial Services Centre (IFSC). This ambitious project serves as a unique model for the future of India’s global financial market and investment landscape.

Key Features of GIFT City

1. Smart City Infrastructure

2. GIFT City’s Financial Ecosystem

Professional Services Providers:

3. Unified Regulatory Environment: The International Financial Services Centres Authority (IFSCA) acts as a single-window regulator, overseeing all financial products, services, and institutions operating in the IFSC zone. This simplifies regulatory compliance and improves ease of doing business

4. Liberal Policies and Tax Incentives

GIFT City – A boon for foreign residents and NRIs eyeing access to India investments

Current state of fund ecosystem at GIFT City (Key statistics)

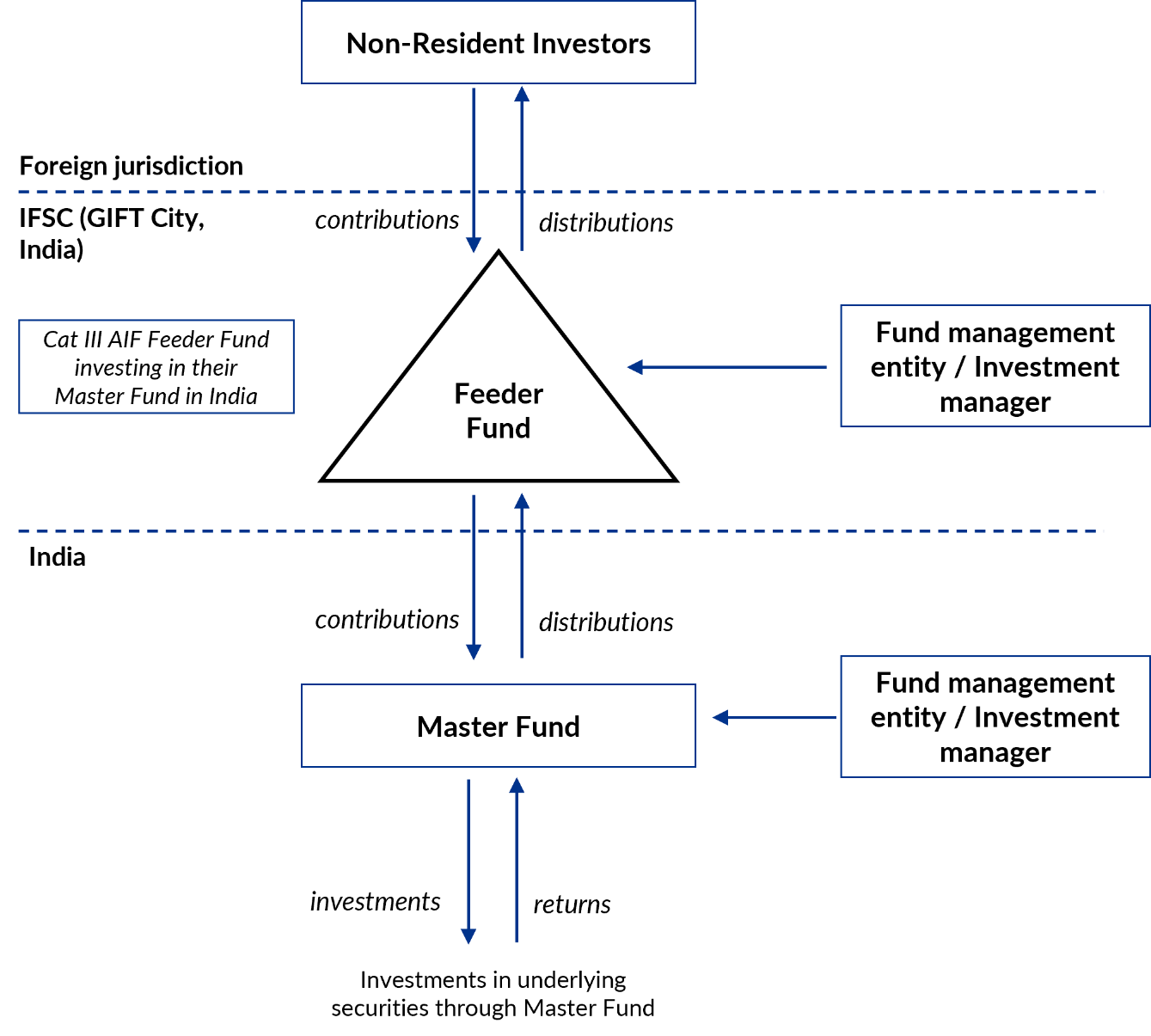

Illustrative fund structure at GIFT City for NRI / foreign investors

Conclusion: The Future of Global Investment in India

GIFT City represents a monumental shift in India’s approach to integrating global financial markets. With its liberal policies, modern infrastructure, and regulatory framework that appeals to both foreign and domestic businesses, GIFT City is poised to be a game changer for investment in India. The ease of capital flow, combined with significant tax incentives and a streamlined regulatory environment, creates immense opportunities for businesses looking to invest or expand in India and beyond.

In the coming years, GIFT City is expected to play a pivotal role in shaping India’s financial future, attracting international investors and positioning India as a global financial powerhouse.

Source – Doing business at GIFT City report by GIFT city authority

India Growth Fund Aust. Pty Ltd ACN 679 187 994 (IGF) as a corporate authorised representative (CAR: 1313345) of Non Correlated Advisors Pty Ltd ACN 158 314 982 AFSL 430126 (NCA). IGF is authorised to advise and deal in wholesale investors only as that term is defined in the Corporations Act 2001. IGF is only authorised to provide you with general information. Under no circumstances does IGF take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. You are advised to obtain your own investment, financial, tax and legal advice before taking any action. Neither IGF, NCA nor any of their related parties, their employees or directors, officers, provide any warranty of accuracy or reliability in relation to such information or accept any liability to any person who relies on it. You should obtain professional advice and read the Fund’s information memorandum (IM) before making a decision in relation to this product. Any forecasts and hypothetical examples are subject to uncertainty and are not guaranteed and should not be relied upon. Past performance is not a reliable indicator of future performance. The information contained in the presentation are confidential and may not be reproduced in whole or in part. If the content of this publication (and/or presentation) conflict with any terms of the IM, then the terms of the IM govern.

Any investment involves risk in whole or in part of capital loss, and the risk of loss of future and previous earnings.

Copyright © 2024 India Growth Funds.