We are strong believers of the India growth story at core and our product offerings have been built in a way to support foreign Australian Wholesale Investors access Indian capital markets in an efficient and easily accessible manner.

The Indian diaspora and global HNIs / UHNIs, NRI, SMSF, Investment company & Trust, Money manager, Asset manager, Financial planners, Fund Manager, Portfolio Managers, Superannuation funds, Alternative Assets and Hedge Funds are actively looking to participate in the India growth story.

We offer a variety of investment solutions for global investors looking to invest in India; through GIFT city. Our investment structure provides opportunity and access to Indian public markets, which is a vibrant avenue for investors seeking exposure to emerging markets. Our offering is only for eligible wholesale investors.

Product APIR Code – NCC0019AU

Master Fund – HDFC Mid-Cap Opportunities Fund

*Rated 4 ⭐ |

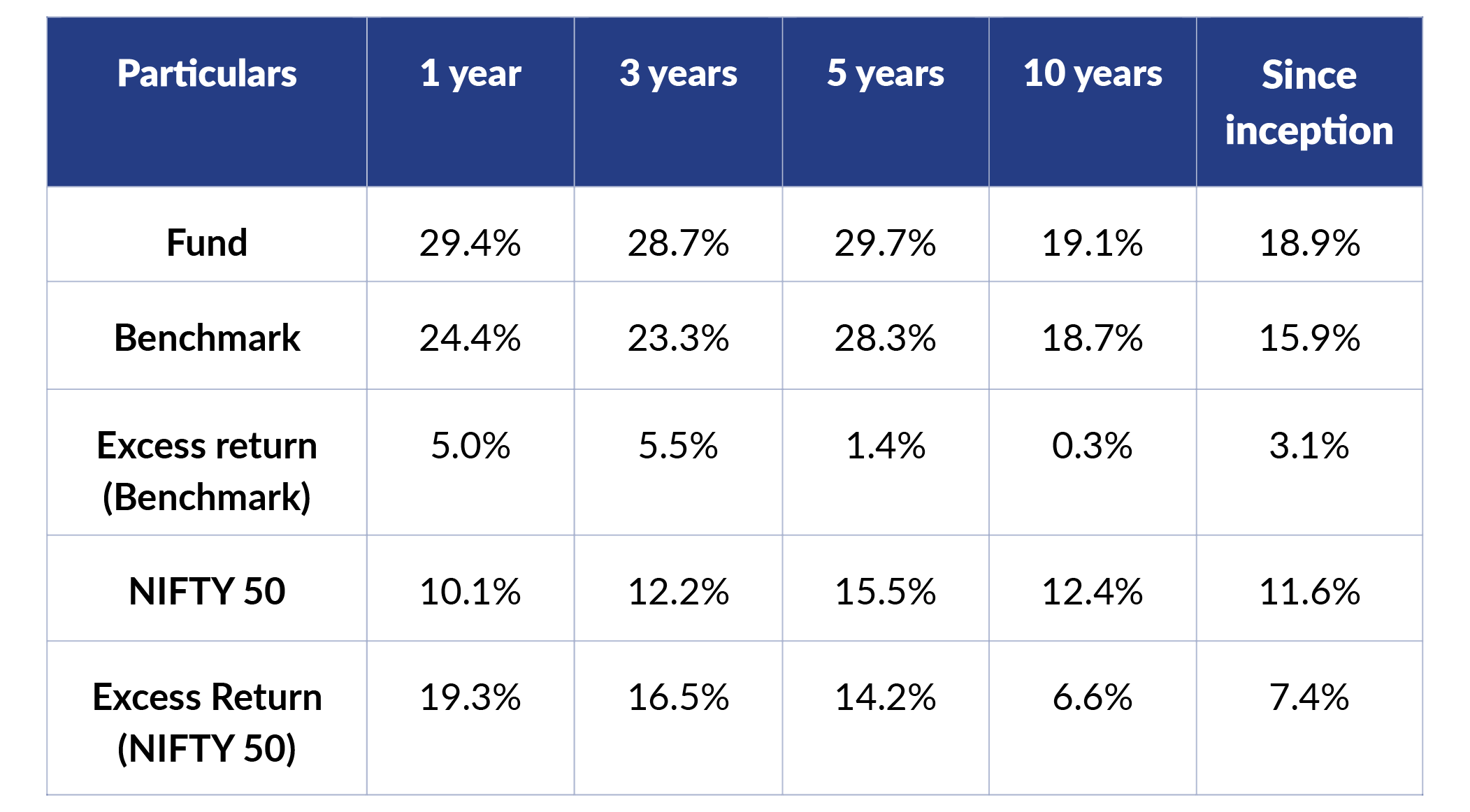

Fund Performance (CAGR) of the underlying Master Fund (HDFC Mid-Cap Opportunities Fund)

Benchmark Index: NIFTY Mid Cap 150

Source – HDFC IFSC December 2024 presentation

*The above furnished returns are based on absolute returns in INR terms and are dated as on December 31st, 2024

*Past performance is not a reliable indicator of future performance

*The rating is only for the master fund i.e “The HDFC Mid-Cap Opportunities Fund”

Our Fund

India Growth Nifty 50 Fund - 2H

Our Fund

India Growth Flexi Cap Fund - 3A

Our Fund

India Growth Flexi Cap Fund - 4H

Our Fund

India Growth Small Cap Fund - 5H

Our Fund

India Growth Balanced Advantage Fund - 6H

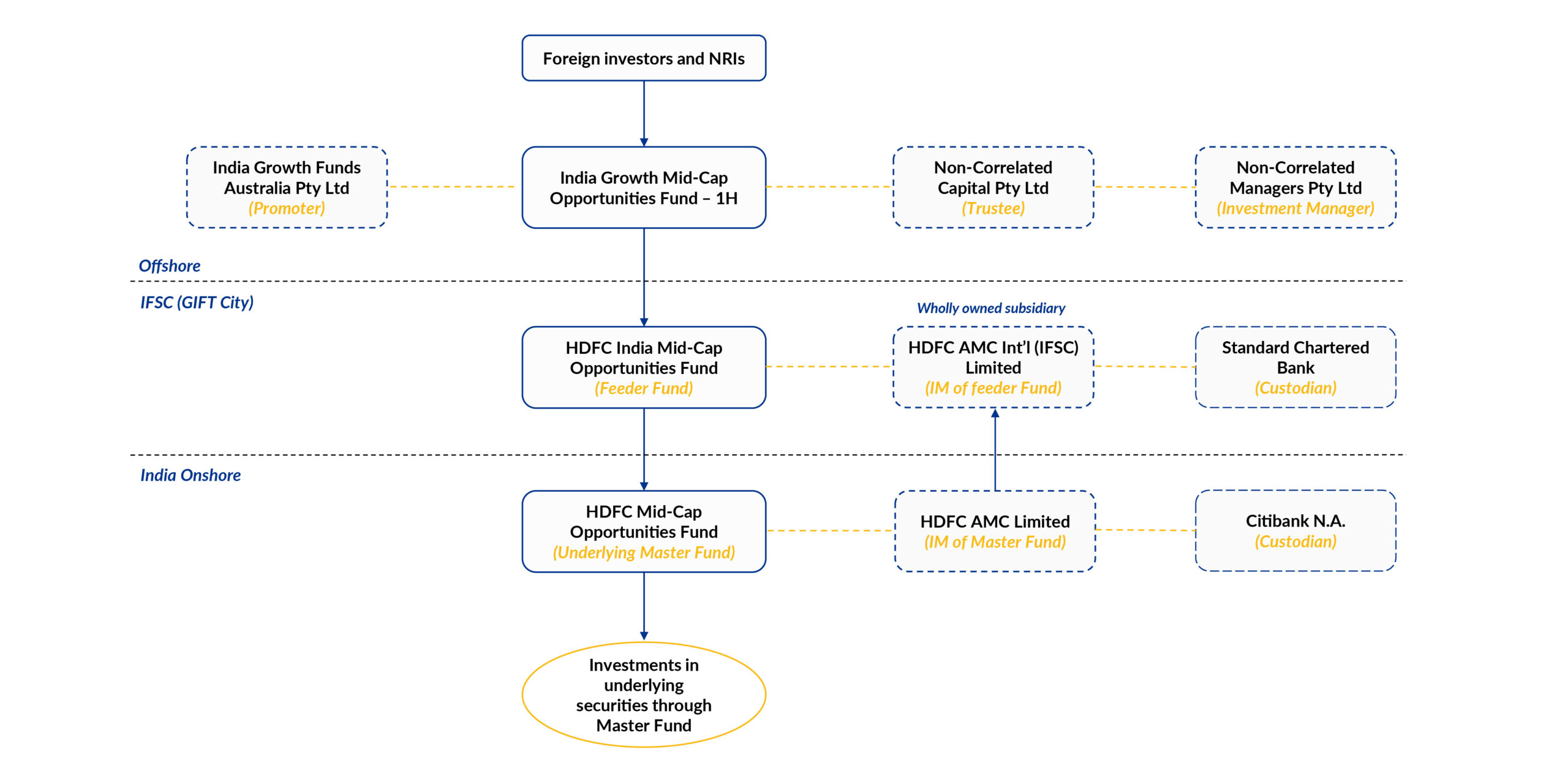

The IG Funds is designed to offer Australian wholesale investors indirect access to Indian mutual funds, facilitating capital appreciation through growth-oriented investments in Indian markets, specifically via a tax-efficient structure set up by IFSCA in GIFT City, Ahmedabad, Gujarat, India.

| Our Current Fund Offering |

|---|

| India Growth Mid-Cap Opportunities Fund – 1H |

| HDFC India Mid Cap Opportunities Fund |

| Our Upcoming Funds |

|---|

| India Growth Flexi Cap Fund – 3A |

| ABSL India Flexi Cap Fund (IFSC) |

| India Growth Equity Opportunities Fund – 2D |

| DSP India Equities Opportunities Fund |

Each IG Fund invests in a feeder fund registered in GIFT City, India, which then invests in a corresponding Indian MF Scheme. This setup enables seamless foreign investment in Indian mutual funds while adhering to tax-efficient strategies.

Risks include market volatility, currency fluctuations (AUD, USD, INR), limited liquidity, and regulatory uncertainties. The investment is not guaranteed, and investors are advised to consider their financial and risk tolerance before committing.

Distributions are not expected; IG Funds are growth-oriented with reinvestment as the primary objective.

Fees include a trustee fee, fund expenses, an annual administration fee, and a variable withdrawal fee based on the length of investment holding. Detailed information on fees is provided in the IM.

We recommend long term view of staying invested in India growth story over 3- 5 years, please refer our Information memorandum for further information.

Only Australian wholesale clients meeting the Corporations Act’s eligibility requirements may invest.

We provide investors access to a portal, give regular updates and statements via email and an app to see investments and performance.

Please visit Contact us.

India Growth Fund Aust. Pty Ltd ACN 679 187 994 (IGF) as a corporate authorised representative (CAR: 1313345) of Non Correlated Advisors Pty Ltd ACN 158 314 982 AFSL 430126 (NCA). IGF is authorised to advise and deal in wholesale investors only as that term is defined in the Corporations Act 2001. IGF is only authorised to provide you with general information. Under no circumstances does IGF take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. You are advised to obtain your own investment, financial, tax and legal advice before taking any action. Neither IGF, NCA nor any of their related parties, their employees or directors, officers, provide any warranty of accuracy or reliability in relation to such information or accept any liability to any person who relies on it. You should obtain professional advice and read the Fund’s information memorandum (IM) before making a decision in relation to this product. Any forecasts and hypothetical examples are subject to uncertainty and are not guaranteed and should not be relied upon. Past performance is not a reliable indicator of future performance. The information contained in the presentation are confidential and may not be reproduced in whole or in part. If the content of this publication (and/or presentation) conflict with any terms of the IM, then the terms of the IM govern.

Any investment involves risk in whole or in part of capital loss, and the risk of loss of future and previous earnings.

Copyright © 2024 India Growth Funds.